|

| Members present: Brian, Bickford, Danak |

After a thorough discussion of the finer points of political commentary in Rocky & Bullwinkle vs. G.I. Joe, we got down to talking about finance.

EWZ hit $40 and is basically oversold at this point, which means that the price is artificially low. This is kind of like the opposite of a bubble--would that make it a black hole? Since we bought it around $72, we might as well hold onto it for a while.

We really need to buy something, anything, anything at all. None of our prospective investments are perfect, but we are trying to

balance several factors as we understand them. For example, AAXJ has a high expense ratio but has a better risk to return in its category. CHIQ and MAPIX are really diversified, which is comforting.

We are trying to avoid having high expense ratios, having too much of our portfolio in a single sector or company, or having too much in emerging markets. Diversification does mitigate losses but also gains. This is the double-edged sword of conservative investment. Since we are in it for the long haul, we have anticipated this.

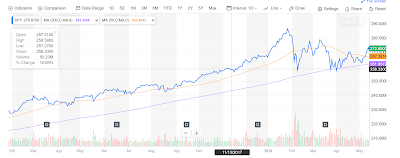

The standard investment advice is to invest heavily in the US economy, and we wondered a bit as to why. We were curious if we are too heavily invested in foreign markets. Is it time to start thinking about making a more domestic buy? The US is still probably the most stable economy in the world, which is reassuring. The S&P 500 is on the upswing, which implies that the US economy is not a good "buy" right now. If we want to catch something on the upswing, we might want to find something that is low or wait for a downturn. In the meantime it seems logical to try and find something that is undervalued.

To get back to our three contenders for the next buy, it seems like CHIQ and MAPIX are good, but AAXJ seems to make the most sense. CHIQ is heavy in consumer cyclical and defensive, which would balance out our portfolio. Its emerging markets in Asia (which is exciting), the returns have been good, etc. There's a lot to like, a lot that is even exciting. However, CHIQ could hit a very frightening bump with all those exciting factors. AAXJ seems more responsible, because it is cheap, it is out of Japan (MAPIX is 22% in Japan), it is well-diversified, and it seems to be performing really well. We could take a look at its peer group of stocks to see if there is an even better buy.

We must remember, that a high risk investment scheme seems good in the long run, but you don't want to end up like

COBRA.

For next week, Income Inequality.

Profit!