Showing posts with label ETF. Show all posts

Showing posts with label ETF. Show all posts

Saturday, May 12, 2018

Trying to save a few dollars isn't worth it.

We've been trying to buy an ETF, but it hasn't gone through because it went up slightly over our buy threshold. We're pretty hands-off, so after two weeks of it not going through, we decided to put in a market order for the fund. This way the buy will go through no matter what. That's what we get for trying to be cheap bastards.

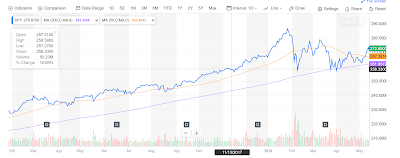

Now let's talk about the DEATH CROSS, which, despite sounding like a rad metal band is actually a real thing:

The blue line in the chart above is the current price for SPY. The orange line is the 50 dma (daily moving average). You can think of this as how things have gone in a fairly recent time frame. The purple line is 200 dma, which is how things have been doing in the longer term.

Watching how these lines are doing in relation to each other is a standard tool for assessing price changes over time. These trend lines could be used to let you know when increases and declines are happening in a sustained way. In the chart above, the three lines appear to be converging. When the blue line is crossing one of these dma lines, it means that the price is under what is has been for the last 50 or 200 days. So when the 50 dma crosses the 200 dma that means that prices are steadily going down. That's our friend, the "death cross". Crossing the 200 dma with the daily price for a few days is a first sign to take defensive action. The "death cross" is when you should really think about or should have already done something. Defensive action doesn't mean we have to dump everything into cash, but potentially the portfolio balance should be change slightly.

Next time, let's talk about what this defensive action may look like. We have a fairly diverse portfolio, so we may already be partially prepared for this.

Profit!

Saturday, April 7, 2018

Old MacDonald has a server farm

We've been doing this for nearly ten years, very lazily on and off. Huh.

ICLN is the etf that we decided that we were going to buy. So do we? It is up 13% since a year ago and meets our criteria. Honestly, it takes us so long to buy that it's weirdly anticlimactic realizing that we've made a decision. Of all the ETFs and stocks in the world why this one? We're in this for the long term and we feel a sustainable energy ETF is a good choice. This one meets our criteria within that.

Buy buy buy!

INFY, our last buy, is up. Good job. Almost 20%! Our original intent was to buy this on a perceived drop and then dump it for cash. That means that is probably time to sell. That also means that there's some potential tax implications We may have to pay capital gains tax on this. Since we've had it less than a year, it just adds to the adjusted gross income of the account holder. We're a small time operation, so that will just impact one of our members (not all that much). The tax laws for long term capital gains tax are changing so that folks at the lower income tax brackets won't have to pay any long term capital gains.

Here's some more info about the changes to the tax code. Bascially, if adding it into your income keeps in the lowest two brackets, you do not pay any taxes on those capital gains. However, if it pushes you up into a 25% or 35% tax bracket you pay capital gains tax and it goes up from there.

For us, selling doesn't impact us that much. We're going to end up paying around 15%. We could reinvest to avoid that, but we move so slowly that it's not gonna happen.

Profit!

Saturday, September 12, 2015

Ew...

|

| EWE is not one of the funds we're considering |

Since AAIT (general Asia infotech) is no longer active, we can narrow our choice down to:

EWY--South Korean ETF

EWT--Taiwan ETF

VGT--Vanguard infotech ETF

Although EWY and EWT are country funds, they both are heavy in infotech and financials, because those are the major exports of each country. Here's the sector breakdown of each:

| Ticker | Expense | Yield | Risk Vs Category | Current Price | Top Sectors | Top Companies |

| EWT | 0.6 | 2.14% | Low | 13.64 | Info Tech - 52% Financial - 17% | Taiwan Semi - 20% Hon Hai - 6% |

| EWY | 0.62 | 1.38% | N/A | 48.58 | Info Tech - 36% Consumer Cyc - 16% Finance - 14% Industrials - 13% | Samsung - 22% Hyundai - 6% |

| VGT | 0.12 | 1.14% | Average | 103.08 | Tech - 88% Financial - 5% | Apple - 16.8% Microsoft - 8.1% |

VGT looks like it has been the most stable overall. When there was a dip in October, VGT is the one that bounced back the most. Our strategy is to lean toward the most down of the three in the hopes of getting something on the upswing.

As an aside, we've been looking at EWT and EWY for quite some time.

We looked at how each would effect our portfolio balancing. We are about 4% for both infotech and discretionary. You can see in the chart above how they would effect our balance. As far as sector weighting is concerned, this leans us toward EWY because it also has some consumer cyclical, which we are low on. It won't unbalance us as much. If we're looking for balance, this will just leave us short on energy and industrials.

If we are wanting to be more balanced and we want the stock that's suffered the most in the last year, EWY is a winner. Apparently we're crazy about EW things.

Profit!

Saturday, June 13, 2015

Shut up and buy something

We are finally putting in a purchase order for three sector-specific ETFs: VNQ (real estate), VHT (a healthcare), VAW (materials).

There are different types of settings for purchasing a stock through a broker such as Scottrade:

Market order--sets the purchase or sell price at the price that the stock is currently trading at. If the market is currently closed, the transaction will go through when it is open again.

Limit order--sets the purchase or sell price at a specific amount. The transaction will only go through when the market value hits the specified amount. If a stock is set to $50, and you set your limit order to $55, then you buy it at $55. Conversely, if you set a limit order to buy at $49, you won't purchase the stock until it hits $49. Usually you can set a duration for the limit. If your limit expires before it reaches the specified price, you simply don't buy the stock.

There are even fancier options, but we won't get into them here.

For next week, we plan to take a look at something to shore up our tech weighting. It might be international, but right now we're just deciding on some options. We're going to compare VGT, a Vanguard tech ETF, with some worldwide tech or possibly some Asian tech funds.

Profit!

Labels:

Buy,

ETF,

Healthcare,

Infotech,

Materials,

Real Estate,

Sector Weighting,

VAW,

VHT,

VNQ

Saturday, May 30, 2015

Time to make a buy

|

| If it's good enough for TS, it's good enough for me. |

We are really risk-averse, which means that making a buy is something that we just sit and wait on. It's been a year or so since we've made a purchase. At our current savings rate, we get three buys a year, or a buy every four or so months. So that means it's decision time. In order to just make a decision, we are going to go with something safe, like a sector fund or maybe even another round of SPY.

The American economy has been doing well and growing fast, so naturally that makes us skeptical about just getting some more SPY. The next approach would be a sector fund. One strategy is to look for a sector that we think is underperforming. After looking at a variety of Vanguard sector funds (we've been happy with their management costs), we decided that we're going to go with a combination of a few funds.

We compared all of the funds in Google finance. We decided to pick the highest fund, VHT, because we think it might have a little more room. The lowest fund, VDE, an energy ETF consists of mostly oil, so we're skipping on that one. The next next lowest recent performing fund is a materials ETF, VAW, and we're going to give it a shot because it's the lowest performing and the rationale is that there should be growth. Finally, we are lowest on real estate in our portfolio, so we're going to give VNQ a spin, because it recently had a drop that we think will come up. As always we're hedging our bets. This will probably mitigate any big movements either up or down, but that is consistent with our long-term strategy.

Profit.

Saturday, February 9, 2013

Talk to Hal.

|

| Members present: Brian, Bickford, Danak |

SPY is hovering at $151, and historically it hasn't gone much past $160. We purchased it at $119, so it has been mildly profitable. It might be a good idea to set an automatic sell, say at $140, just to limit the amount that we can lose in the case of a crash. Using automatic orders is good for a small, informal group such as ours. We meet once a week, and none of us is at the computer all day looking at the numbers. Using these tools allow us to keep a watchful, robotic eye on our money.

EWZ is steady.

ENZL is humming along, as is ATT.

Now, on to the problem of figuring out where to put our money.

We took a look at a few different funds, and did some reading. A while back, we were thinking about investing in HILO, an emerging markets ETF. It is billed as a low-volatility, emerging market, dividend ETF. Also, we looked at EELV and EEMV. HILO is unfortunately a little more "expensive," because it has a high expense ratio. The fund is performing well, but it drags a little because it has to work that much harder to make up for the higher expense ratio.

Next week we should delve further into these funds, and maybe even make a decision on a buy.

Profit!

Saturday, February 25, 2012

Fixed income? I'll fix your income!

Members present:

|

| Brian, Bickford, Danak |

We started talking about the next buy and Brian would like us to look into some fixed income investments.

Fixed income refers to any type of investment that is not equity, which obligates the

borrower/issuer to make payments on a fixed schedule, even if the number of the payments

may be variable (as always, from Wikipedia).

So basically, we are talking about things like bonds, with a guaranteed return. Why is it guaranteed, you ask? Because they said so. That is why you want to buy AAA-rated bonds, because the "guarantee" gets closer to being true.

This is what ishares has available, by the way.

Also, Brian had found an interesting Wired article about the clean tech bubble, and the basic gist is that clean tech was a great idea, that is, until natural gas became so cheap. Too bad about the potential environmental repercussions of things like Fracking. It is an interesting article since it goes down various sectors of green-tech, and it takes a look at the hopes, reality, and future viability of each. It is definitely worth a read. Also, the writer of the article had nice things to say about Tesla, and the potential promise of their sedan. That said, it will still be about $50K and that can get you a little more muscle if you are okay with chomping on dinosaur bones for a little while longer.

As with all things, cost is going to be the factor that drives any innovation. Right now, the cost of electricity isn't high enough for solar/wind/etc. to be worth it. The same goes with petrol, which makes electricity (and definitely hydrogen) not quite there yet.

Bickford wanted to talk about ETFs as well:

Apparently ETFs are becoming rather popular. The idea that we could get our hands on a variety of stocks in one purchase was appealing to this group, so I guess we jumped on that trend. However, there are some complaints leveled against ETFs, because when one buys or sells an ETF, an entire sector is being traded. The argument is that it removes liquidity*, because all the stocks in the fund are being moved together. Then there are others who respond that there is not really enough money in ETFs to make a big difference, since comparatively much much more money is in individual stocks.

*There was a brief discussion about why this might be a bad thing, and Bickford mentioned something about this lack of liquidity potentially causing the value of a stock to be based on artificial means, but then again, aren't the markets sort of based on emotion too? Where are our robot overlords when you need them?

And now, the charts:

|

| SPY: $10 above the 200DMA. We bought it at $119, and it is now $136! |

|

| AT&T: Dividends some time at the beginning of April? We should hear some time at the end of March about what it will be. |

|

| EWZ: Back up to $70 (nearly), which is almost our purchase price. What a long, strange trip it's been. Hang in there, Brazil! |

For next week:

*Dividends: research during the meeting.

*Determine the volatility of our portfolio.

Profit!

Subscribe to:

Posts (Atom)