|

| Members present: Brian, Bickford, Yousef |

So we were talking online storage, and Bickford brought up Box.com, a rival to Dropbox. Apparently, you can upgrade from the free 5GB of space to 50GB of cloud storage simply by logging on with an HP touchpad. But you say, I don't have one of those? Just find someone who does (like Bickford). Congratulations, you have some more online storage, but why should anyone in a finance club care about that? It seems like if one is intrepid, one can get in on various free online storage deals. Haven't paid for a dropbox, or a google drive, or now a box account. The internets wants to give you stuff to try it out, in the hopes that you won't be a cheap bastard and just stop at the free level. It beats clipping coupons. Yay free!

|

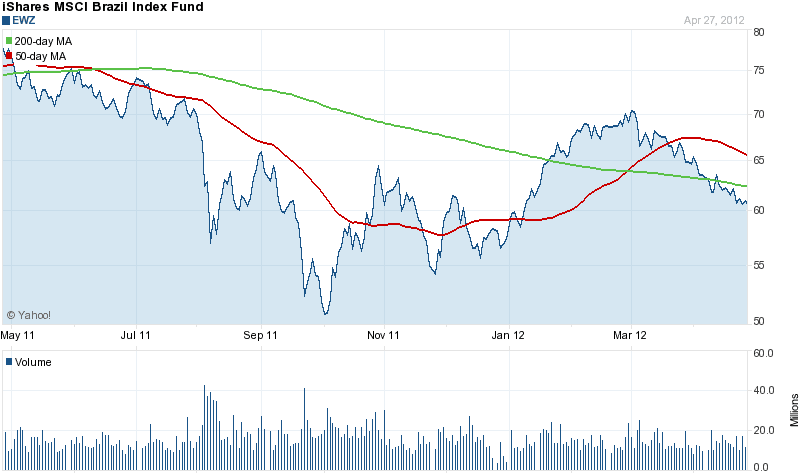

| EWZ: continues to tank. |

|

| AT&T: Looking good. |

|

| SPY: Up is good. |

So what is the next buy?

New Zealand. There is a NZ ETF:

ENZL Top Ten Holdings

- Telecom Corporation of New Zealand Ltd (TEL): 15.78%

- Fletcher Building Ltd. (FBU): 15.34%

- Auckland International Airport Limited (AIA): 6.43%

- Sky City Entertainment Group Limited (SKC): 6.27%

- Chorus Ltd Common Stock Npv: 5.02%

- Contact Energy Limited (CEN): 4.62%

- Fisher & Paykel Healthcare Corporation Limited (FPH): 4.50%

- Sky Network Television Limited (SKT): 4.17%

- Ryman Healthcare Limited (RYM): 3.90%

- Goodman Property Trust (GMT): 3.85%

And here's a chart:

And finally, here is a listing of our proposed portfolio by holdings (by sector).

Profit!

No comments:

Post a Comment