Saturday, May 12, 2018

Trying to save a few dollars isn't worth it.

We've been trying to buy an ETF, but it hasn't gone through because it went up slightly over our buy threshold. We're pretty hands-off, so after two weeks of it not going through, we decided to put in a market order for the fund. This way the buy will go through no matter what. That's what we get for trying to be cheap bastards.

Now let's talk about the DEATH CROSS, which, despite sounding like a rad metal band is actually a real thing:

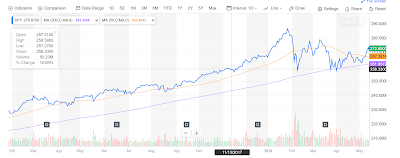

The blue line in the chart above is the current price for SPY. The orange line is the 50 dma (daily moving average). You can think of this as how things have gone in a fairly recent time frame. The purple line is 200 dma, which is how things have been doing in the longer term.

Watching how these lines are doing in relation to each other is a standard tool for assessing price changes over time. These trend lines could be used to let you know when increases and declines are happening in a sustained way. In the chart above, the three lines appear to be converging. When the blue line is crossing one of these dma lines, it means that the price is under what is has been for the last 50 or 200 days. So when the 50 dma crosses the 200 dma that means that prices are steadily going down. That's our friend, the "death cross". Crossing the 200 dma with the daily price for a few days is a first sign to take defensive action. The "death cross" is when you should really think about or should have already done something. Defensive action doesn't mean we have to dump everything into cash, but potentially the portfolio balance should be change slightly.

Next time, let's talk about what this defensive action may look like. We have a fairly diverse portfolio, so we may already be partially prepared for this.

Profit!

Labels:

Buy,

ETF,

Market Trends,

SPY

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment